The China vs. Local supplier debate is usually framed as “who’s cheaper?” That’s a portion of the question. For global snack brands, the real trade-off lives inside an Impossible Triangle of Technical Complexity, Production Consistencyund Controllable Unit Cost.

So, DQ PACK, a führender Hersteller kundenspezifischer flexibler Verpackungen, can tell that evaluating a Chinese snack packaging manufacturer means asking: which partner sits closest to the “usable solution” for my SKU’s complexity and channel needs?

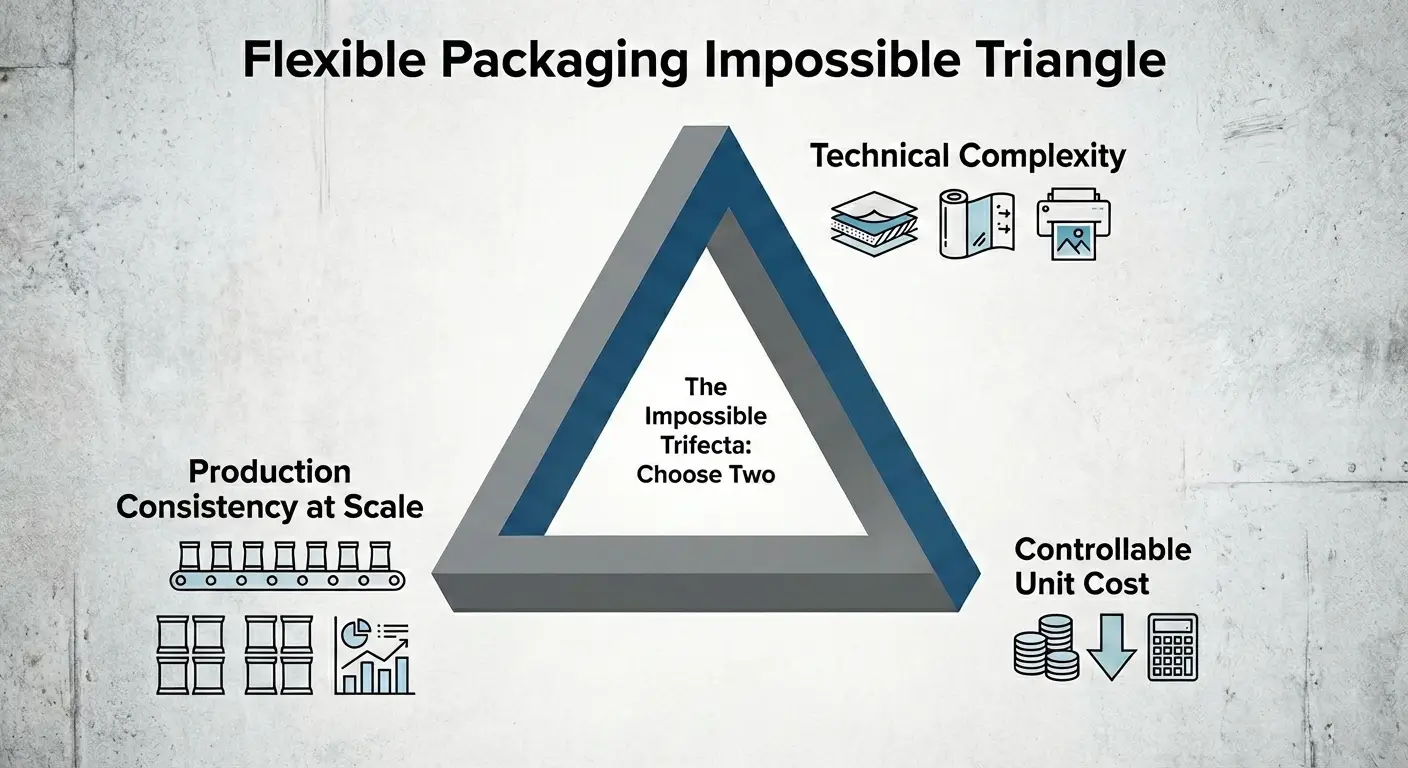

The Flexible Packaging Impossible Triangle — Quick Frame

Three dimensions matter:

- Technical Complexity: multi-layer laminates, EVOH/EVOH alternatives, foil, special seals, high ink coverage.

- Production Consistency at Scale: batch-to-batch reproducibility, retention samples, documented process windows.

- Controllable Unit Cost: the marginal cost of adding complexity (extra layers, special varnishes, bespoke sealing).

You can improve two, but not all three, at once. Smart procurement targets the right two for each SKU rather than hunting for an impossible trifecta.

Where Local Suppliers Typically Sit (Strengths & Limits)

Local packaging suppliers commonly deliver:

- Strong regulatory traceability and audit friendliness.

- Low variance and controlled change management.

- Shorter domestic lead times and minimal communication friction.

Their structural limits are also clear:

- Complex laminates become “non-standard” and carry large price premiums.

- High MOQ or tooling economics make small SKUs expensive.

- Conservative process attitudes reduce willingness to iterate rapidly.

In short, local suppliers often occupy the Consistency + Compliance corner, sacrificing the Cost of Complexity.

Where a Chinese Snack Packaging Manufacturer Fits in the Triangle

China’s flexible packaging manufacturing ecosystem gives a different trade-off:

- Dense upstream supply of films, metallizers, inks, adhesives, and converters.

- Mature, repeatable processes for high-barrier builds (PET/VMPET/PE, AL foil laminates, EVOH encapsulations).

- Capacity to run many SKUs in parallel and amortize fixed costs across volume.

This means a Chinese snack packaging manufacturer typically sits near the Complexity + Cost corner: high technical capability at a commercially attractive incremental cost. That’s why brands use Chinese partners as a “complexity engine.”

Unit Price Vs Total Cost of Ownership (TCO)

A low per-bag quote is seductive but incomplete. Compare these TCO dimensions:

- Tooling and plate amortization per SKU.

- MOQ-driven inventory carrying and obsolescence risk.

- Scrap, rework, and print defect rates (quantified).

- Expedited freight when shortages or defects happen.

- Compliance testing and documentary overhead.

On complex SKUs, China snack packaging manufacturers often win on TCO per unit of complexity because plate/workflow amortization and roll-utilization are more efficient there than in local shops.

Quality: Capability Vs Consistency — Define What “Quality” Means

Quality has two faces:

- Capability: Can the factory produce the structure you need? (high-barrier, foil, EVOH, special seals)

- Consistency: Can it reproduce those properties every batch?

Chinese snack packaging manufacturers usually score high on capability but exhibit wider variance across the market — some factories are world-class, others are not. Local suppliers generally deliver tighter variance but at lower capability. Hence, selecting the right China snack packaging manufacturer is a supplier-selection exercise, not a country bet.

Why Buyers Fail in China

Failures are rarely about geography. Common procurement mistakes:

- Confusing sales polish with engineering depth.

- Accepting “high barrier” without OTR/MVTR and batch-level data.

- Skipping pilot runs on the intended filler.

- Not contractualizing change control and acceptance criteria.

Successful buyers speak engineering language, demand batch-linked metrics, and treat Chinese partners as technical collaborators rather than purely low-cost vendors.

Evaluate a Chinese Snack Packaging Manufacturer Quickly

Ask every prospective China snack packaging manufacturer for:

- Pilot-run validation on your filler or a validated OEM line.

- Batch-linked OTR/MVTR, seal-strength, and drop/burst reports.

- Declarations of Compliance for inks, adhesives, and films.

- Documented change-control policy and notification SLAs.

- Historical yield/defect metrics and retention-sample procedures.

If a factory resists any of these, flag it as high risk.

Schlussfolgerung

There is no universal winner. The procurement triumph is a clear mapping: match SKU complexity and channel needs to the supplier profile. A Chinese snack packaging manufacturer is unmatched for engineered complexity at competitive marginal cost; local suppliers excel at repeatability and compliance comfort. The savvy buyer orchestrates both — optimizing TCO, risk, and time-to-market.

Über DQ PACK

DQ PACK is a führender Hersteller kundenspezifischer flexibler Verpackungen in China, offering custom high-barrier snack packaging for B2B brands. With mature processes, advanced laminates, and in-house quality controls, DQ PACK ensures a stable, repeatable supply for complex SKUs at competitive costs.

By combining technical capability with reliable production and tailored services, DQ PACK helps procurement teams minimize risk, optimize total cost of ownership, and launch snack products efficiently across retail, e-commerce, and private-label channels.